Have you ever heard of the trader’s trilemma? I’m going to assume “NO!”. This neologism comes from us, derived from the dilemma -> situation in which you are forced to choose between two equally [unpleasant] things, but with the addition of another problem. Many people who start trading are out to make a quick profit, to get rich quick. But, as with most business opportunities, this doesn’t work with trading either. In trading too, you are not rewarded for “getting started”, but for “sticking with it”. It needs plans and processes, similar to a business. And only then does it no longer have anything to do with a “casino” or gambling, but with a targeted and planned approach. And that this is the case can be seen, for example, in the statistics from brokers, who must now be able to disclose

how many private individuals lose money with them. Usually between 70 and 90 per cent. That sounds like a lot, and it is. So most people lose money when trading. The good news, however, is that between 10 and 30 per cent make money. And most of them are sustainable. And this naturally raises the question: what do these traders do differently from the rest?

Well – these traders treat trading like a business – not a hobby. You’re probably asking yourself: why is this so important? – Well, it’s a question of attitude, of mindset. I want to earn money with a business. I usually do a hobby without the intention of making a profit, quite the opposite: a hobby usually costs me money! And it’s the same with trading: if you see trading as a hobby, it costs you money!

Those of you who have already been to my coaching sessions know that I have two basic rules when it comes to trading:

- Don’t lose any money! (Because money that is lost is all the more difficult to get back!)

- You are not allowed to give up! (Life always gets in the way!)

So how do I move away from “hobby trading” and towards “business trading”?

I have to treat trading like a business. And that starts with drawing up a business plan for trading, a trading plan. What such a trading plan might look like will be discussed in detail next month.

In principle, the trading plan contains exactly the three most important points that represent success as a trader:

You can also see from the weighting exactly what is important for success in trading. Now one or the other will certainly ask the question: “Where did you get this data from?”. Well: there is no study on this (yet), these are our experience estimates, which are not to be seen as absolute, but as approximate values.

“The strategy”

Strategy only accounts for 10% of success as a trader. It’s amazing how many people who start trading on the internet are simply keen on signals or entry opportunities. Especially on social media, this sometimes takes on very bizarre forms, e.g. channels in messenger apps where hundreds of people “supposedly” get rich, sometimes for a fee. For me, the question of sustainability arises, especially when it comes to a topic like money and trading. I become dependent on a signal or strategy provider who gives me possible entry points.

If you then run trading as a business, the question of risk should arise very quickly. For example: “What if the signal provider suddenly no longer exists?”

So wouldn’t it be better to invest in education and training and be an independent, free trader? And in the final stage, be able to build your own strategies and adapt them to new market conditions? Trading is often associated with “freedom”. And for me, freedom means not being dependent on one person, company or system and being able to buffer changes in the market with the necessary resilience.

Even if the strategy(ies) “only” account for 10% of success as a trader, they should not be underestimated, and of course you need (a) functioning strategy(ies).

Strategies give us a certain advantage over the competition. In our case, the competition is other traders, be they retail traders like us or institutions such as banks, pension funds, hedge funds or even large companies that hedge currency risks in international money transfers on the forex market, for example.

I always like to describe the advantage as the same one that casinos have. It’s a well-known saying: “The bank always wins!”. And if you look at roulette, for example, it is a green field, the “green zero”, that gives the bank the statistical advantage. Of course, as a player you can get lucky and win, but the probability lies with the bank, and the more players there are, the higher the bank’s profit.

As traders, we therefore try to gain a statistical advantage through two different points. And one of them is the strategy that we have found out in backtesting that it works statistically and gives us winners more than 50% of the time.

I describe the second statistical advantage in the following paragraph:

“Risk and trade management”

Even more important than the strategy is the right risk and trade management. And this is where I get the question in my seminars: “What’s the difference?”

Well, it’s the timeline: I define my risk management before I enter a trade, how I manage the trade happens while the position is already open and running.

In risk management, I determine how much I am willing to lose. Since my rule no. 1 says: “Don’t lose money!”, we must limit our losses. And the only way to do this is with a stop/loss, i.e. a stop order that is placed at the same time as the order. At least in swing and day trading, those who scalp often trade with a mental stop loss. I therefore set the level for the stop loss strategically, for example below the last low or above the last high. And then I have to determine how much will actually be lost if the stoploss is actually triggered. In CFD trading, this is a maximum of 1% per position. That is our calculated risk. If you trade on a prop account, for example, you can reduce this risk even further to 0.5% or even 0.25%.

Let’s do a little calculation example here:

So I have 1% risk in absolute €: 100 at risk. The worst case scenario occurs, the stop loss is triggered and the €100 is gone. So I still have €9,900 in my account. Now I open the next trade and the risk is reduced to €99. So you can see that if I produce a certain drawdown, I automatically lose less. And vice versa, if I enter the profit zone, the risk also increases, but so does the potential profit.

Another important point in risk management is the question of portfolio risk. Here it can be advisable not to take a so-called bulk risk. This means not opening several trades in similar markets. These can be share indices, which often behave similarly, gold and silver often have the same direction, and with currencies, make sure that one currency does not become too dominant. For example, if I open EURUSD, GBPUSD long and USDJPY short, I assume three times that the USD will weaken. However, if the opposite happens and the US dollar strengthens for whatever reason, then I suddenly have three positions in the red and have lost three per cent instead of one! And it can happen that I get several entries in a strategy with a weakening dollar. The trick here is to choose the best one and not blindly jump on every setup like in hunting mode.

“Risk-reward ratio”

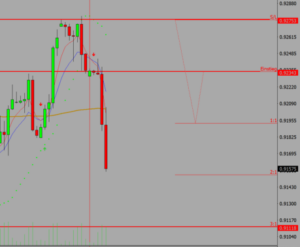

Once I have determined my risk, I should think about the potential profit. And this works via the so-called risk-reward ratio, or CRV for short. This tells me how my calculated risk relates to a potential profit and how I manage the trade in this respect. As a rule, there is always a minimum CRV, i.e. a profit that must be realised in order for the strategy to be successful in terms of probability. In most cases, the minimum CRV is 1:1, i.e. 1% risk, 1% profit. And there are now several ways to manage a trade effectively so that the risk/reward ratio is as high as possible.

One of the options is to work with a take profit. The take profit is like a stop loss, only in the other direction, and it leads to automatic profit-taking. So I can place my take profit at +1%, for example.

For example, I can place my take profit at +1%. The price must then cover the same distance as the stop loss, only in the other direction.

If we want to achieve a CRV of 2:1, i.e. 2% profit with 1% risk, then the price must cover twice the distance to the stop loss, but of course also in the opposite direction. This is our second, decisive advantage as a trader.

I can reduce my required probability with a positive risk/reward ratio! If I always work with a CRV of 2:1 and the corresponding take profit, I can lose more often than I win and still be profitable! That’s right!!!

But this is where the third point comes in, namely trading psychology: we humans are programmed to be right. And suddenly this is no longer necessary! Of course, this harbours immense intrinsic conflict potential, which you have to come to terms with first.